Blog & News

What You Need to Know About Corporate Meeting Minutes

What Is A Statement of Information?

"A statement of information is an annual report that is filed by business entities with the business' current information..."

Employee Vs. Sub-Contractor

"Beginning March 11th, 2024, the Department of Labor will begin using a..."

New 1099-K Filing Rules Delayed Again

"Do you sell goods or services and receive payment through a third-party..."

Should Your Convert Your Personal Vehicle To Business Use?

"Wouldn’t it be nice if you could use all of your personal purchases as tax..."

Family Loans For Affodable Home loan Interest Rates

"With the current national average interest rates for 30-year and 15-year fixed-rate..."

2024 Mileage Rates Updates

"Mileage rates for travel are now set for 2024. The standard business mileage rate increases..."

Don't lose out on the Energy Efficient Home Improvement Credit

"The 2023 Energy Efficient Home Improvement Credit helps..."

California Expands Paid Sick Leave Requirement

"California has enacted legislation that will, in part, expand the amount of paid sick leave to which..."

What Is the Difference Between the Terms "Basis" and "Capital"?

"Many S-corp owners are mystified by the tax terms related to their business. So..."

Maximizing the Tax Deductions of Building an ADU

"If you have extra yard space and want to earn extra money, then you may want to consider building and..."

How Educational

Assistance Programs Can Help

Pay Student Loans

"Did you know that employers can use educational assistance programs to..."

What IS Unearned Income

"Unearned income is often defined as 'anything that is not earned income.' If you find this kind of definition a little..."

Our Tip to Avoid Late

Payment Penalties

"The tax code has a basic set of rules to determine if you owe a late tax payment penalty. The rule is..."

Financial Perks of

Adding A Business Gym

"While there are always risks involved in owning a business, there are some pretty great perks too! For instance ..."

Tips For Creating an Estate Plan

That's Right For You

"Estate planning may sound like something that only the ultra-rich need to worry about. But there are many..."

Some Exciting News!

"In early fall 2023, Gold Standard Tax & Accounting will be opening the doors of its very first brick and mortar office! ..."

Improve Next Year's Taxes Now

"Whether you receive a big refund or face a bill on tax day, taking action now can ensure..."

Understanding the

Marriage Penalty

"Marriage brings many joys, but one of the challenges might show up in an unexpected place - your tax return..."

Your Sole Proprientorship May Be

An Audit Target

"Each year the IRS publishes their activities in a publication called the Data Book. For the past several years the..."

Using Your HSA In Retirement-

Part Two

"In our last article, we discussed the many benefits of using your HSA as a retirement plan. We could have..."

Using Your HSA In Retirement-

Part One

"Health savings accounts (HSAs) were intended to be used to help pay for medical expenses. But they're actually..."

Reduce Your Property Taxes!

"Property taxes typically lag the market. In bad times, the value of your home goes down, but the property tax..."

Three Tax Credits Your

Kids Will Age Out Of

"Your kids are getting older. Before you know it, they’ll be dating, driving, and entering college. Tax breaks drop..."

Understanding the

Gift Giving Tax

"In an effort to keep taxpayers from transferring wealth from one generation to the next tax-free, there are specific..."

No 1099, No Deduction!

"We're approaching the halfway point in the year, and we thought that it might be a good time to discuss..."

Put Your Tax Refund to Good Use!

"Three-fourths of filers get a tax refund every year, with the average check weighing in at $2,972*. Here are some basic ideas..."

What We Learned From the

2023 Tax Season

"Here we are, just on the other side of April. This was our best tax season yet! And here's why..."

Avoiding the 10% IRA Early

Withdrawal Penalty

"Ordinarily, a 10 percent penalty must be paid if a taxpayer withdraws funds from an IRA or other retirement account..."

S-Corps and Family:

Claiming Health insurance Deductions

"Let's say your 30 year old child works for your S-Corporation. They own no stock..."

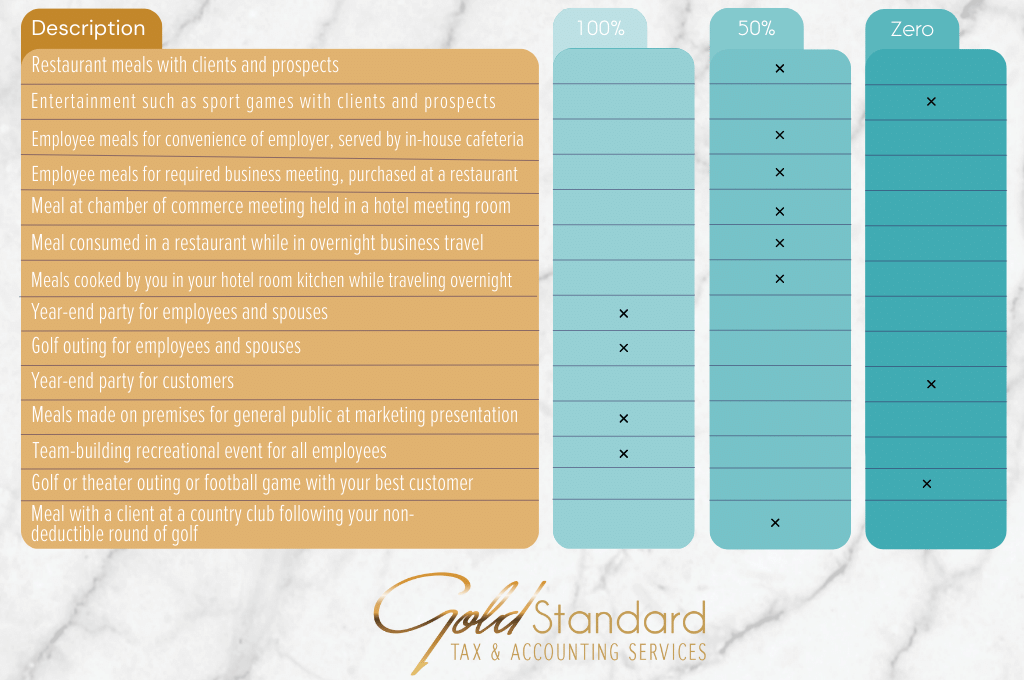

2023 Changes to Meals and Entertainment Deductions

"As of now, the deduction for business meals is only 50 percent—a significant change from the previous 100 percent deduction..."

Has your Return Been

Chosen For An Audit?

"Less than 1% of individual tax returns are usually selected for an audit. The percentage increases for higher..."

Expensing Vs. Depreciating

Your Capital Asset

"Most of us are familiar with the concept of expensing an asset. However, if you are a business owner..."

Self-Employment Taxes for Partnerships and LLC Members

"Does a member of a limited liability company (LLC) or a partner in a partnership have to pay..."

Leveraging Your Child's

Lower Tax Rate

"It's likely that you're already aware of more well-known provisions in the tax code like the Dependent Child Care Tax..."

2023 Health Insurance Update

for S-Corp Owners

"If you operate your business as an S corporation, you continue to enjoy good news in 2023 when it comes to your..."

Tax Extension for Californians

Impacted by Winter Storms

"California is extending the tax filing deadline for Californians impacted by December and January winter storms..."

What your Should Know About the Work Opportunity Tax Credit

"Businesses hanging up their "Help Wanted" signs should be sure to check..."

Understanding the IRS Term

"Contemporaneous Records"

"According to the IRS, the term "contemporaneous records" means that the records used to support a claim on..."

New Electric Vehicle and Home improvement Credits

"Tax incentives for purchasing clean vehicles and installing high efficiency home improvements are..."

Avoid These Surprising Tax Hits

Part Three-

The Limited Loss

"To demonstrate how the limited loss works, let's use..."

Avoid These Surprising Tax Hits

Part Two-

The Kids Are Growing Up

"Raising children is one the most challenging jobs a human can have..."

Avoid These Surprising Tax Hits

Part One-

The Home Office

"Our tax code contains plenty of opportunities to cut your taxes. There..."

Leasing Vs. Financing-

The Advantages

and Disadvantages to Both

"When the time comes to acquire a new vehicle for your business, there are..."

You Can't Deduct That Loss

"If your activity is a business, your income can be reduced by all your qualified business..."

2023 Health Savings Account Limits

"You may be wondering, "What is a Health Savings Account?" Well, an HSA..."

Five Things That May Trigger

an IRS Audit

"Each year, the IRS audits over 1 million tax returns. With agency resources shrinking..."

The New 62.5 Cent Mileage Rate-

How Will It Affect You?

"Likely, you've taken note of the recent country-wide spike in gas prices. Well, the..."

Cut Employment Taxes With the

S-Corporation: Part Two

"For 2022, lawmakers levy the self employment tax at the painfully high rate of 15.3 percent on the first..."

Cut Employment Taxes With the

S-Corporation: Part One

"If you report your business on Schedule C of your Form 1040, you may notice that the..."

Young Entrepreneurs and Taxes:

When the Lemonade Stand

Makes Bank

"Everyone, including minors, must file a tax return if they had net earnings..."

How to Monitor Your

Employee Withholdings

"As an employee, your employer withholds taxes based on what you claim on your..."

Does Your Summer Job Income Qualify for Tax Exemption?

"The summer season brings new life, warm weather, and boundless..."

Now Is the Time for A

Withholding Review

"With tax season in the rear-view mirror, now is the time to take a hard look at your..."

New IRS Transaction Reporting Laws- How Will They Affect you?

"A recent tax law change by this edition of Congress now requires ..."

Make the Most of Your

Charitable Donations

"You may have noticed that recent changes in the tax code have done..."

Does Your CA Business Qualify for Exemption from the CalSavers Program?

"California state law requires employers to either offer their own ..."

How Rental Property Owners Can Avoid the Net Investment Income Tax

"The net investment income tax, or NIIT, is a hefty 3.8 percent tax on top of..."

California's New SALT

Law Explained

"By making this election, you could reduce your personal federal taxable income..."

Grouping- Part Two

How to Make the Election to Group

"Revenue Procedure 2010-13 requires grouping disclosures in your tax..."

Grouping- Part One

A Tax Strategy for Owners of Multiple Businesses

"When you own more than one business, you need to consider the grouping..."

Is Now the Time to Transfer Your Home to Your Child?

"When you own more than one business, you need to consider the grouping..."

Is the Classification Settlement Program (CSP) Right for You?

"If you have workers that you treat as independent contractors, this article..."

Tax Considerations When Handling Someone Else's Estate- Part 2

"Grieving the loss of a loved one is pa..."

Tax Considerations When Handling Someone Else's Estate- Part 1

" When a loved one passes away..."

Why You Need a Trustworthy Bookkeeping and Payroll Service

"Handle payroll taxes the wrong way and you could end up in an IRS..."

You Own a Vacation Rental- Is It Best to File a Schedule C or E?

"If you show a tax loss on your rental property, Schedule C is a great..."

How Hiring Your Child Can

Be a Win, Win

"The hire-your-child strategy works best for a Schedule C proprietorship..."

Do You Need to Enroll in the CalSavers Program?

"CalSavers is California's retirement savings program designed for the..."

The 105- HRA- Is It Right For Your Business?

"Does Your Business Qualify To Use The 105-HRA? The 105-HRA gives you..."

Is a Reverse Mortgage

Right for You?

" When you think of a reverse mortgage, you may not think of using it as a tax..."

Do You Qualify for Home

Internet Deductions?

"If you do some work at home, chances are, you use your home internet..."

Contact us:

[email protected] | CA (760) 888-6247 | NY (845) 237-4060

Copyright © Gold Standard Tax & Accounting. All Rights Reserved.